When general partners (GPs) look to

fundraise for a vehicle, creating a list of limited partners (LPs) and institutional investors is often the first step. It’s crucial to get this list right because it forms the foundation for the rest of the fundraising process. On the other end of the spectrum, LPs conduct

fund manager due diligence on GPs to evaluate past performance and mitigate risk. When strategies align, an LP/GP relationship—which can last anywhere from 10–18 years—is born.

Especially relevant for GPs, PitchBook tracks more than

36,000 LPs across the private markets, including details on their previous commitments, preferences and more. Here’s how GPs can leverage our data and insights to quickly create a dialed-in target list of LPs.

Creating a target list of LPs and institutional investors

PitchBook allows you to efficiently create a shortlist of promising LPs based on criteria that matter to you. This includes their mandates, target and actual allocations by asset class, past and present commitments, fund preferences and dry powder. For example, you could identify top pension funds in California that have made the most commitments to buyout funds, or list all of the LPs in Europe that have a current mandate requiring them to commit to energy-focused funds.

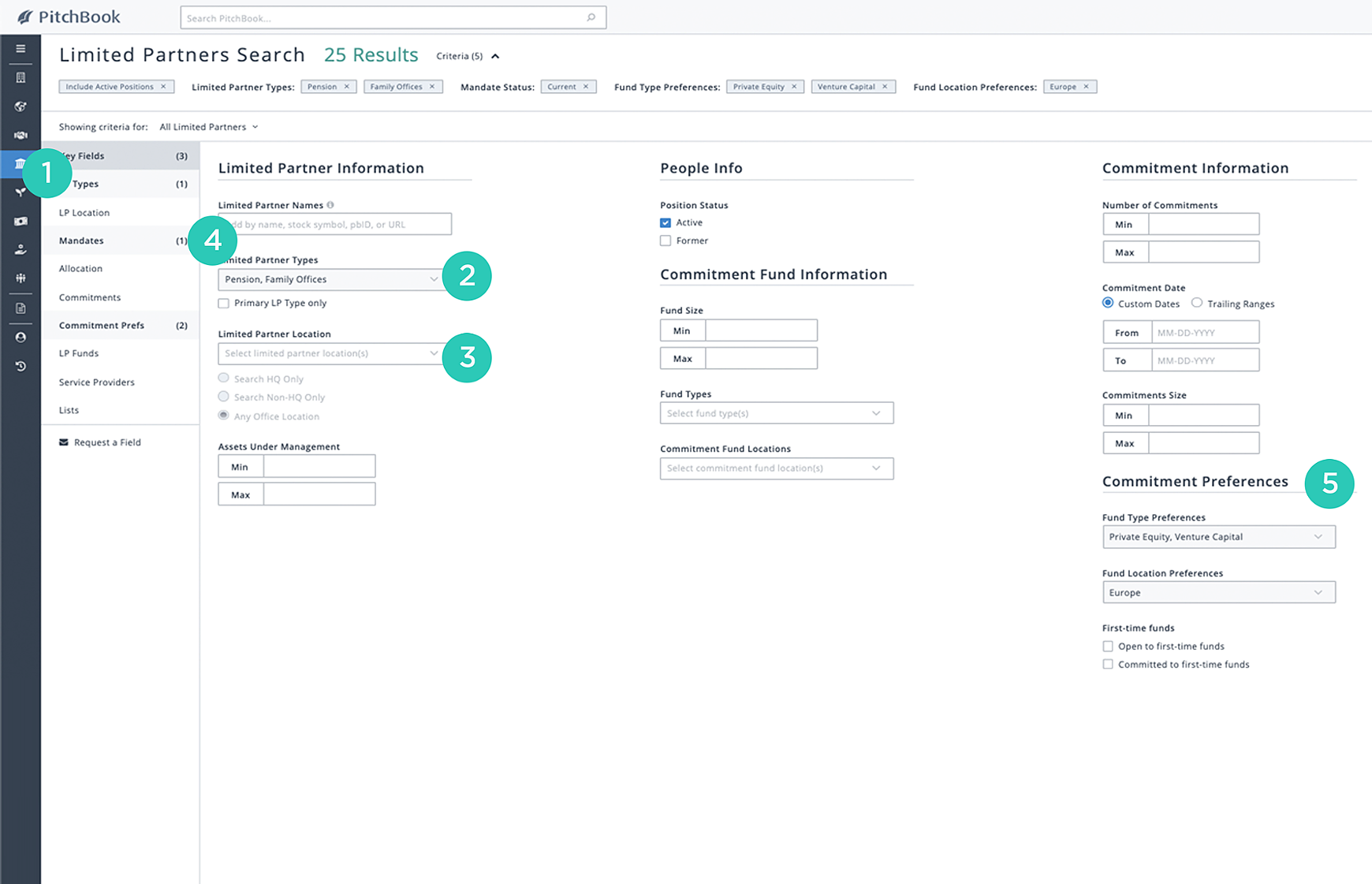

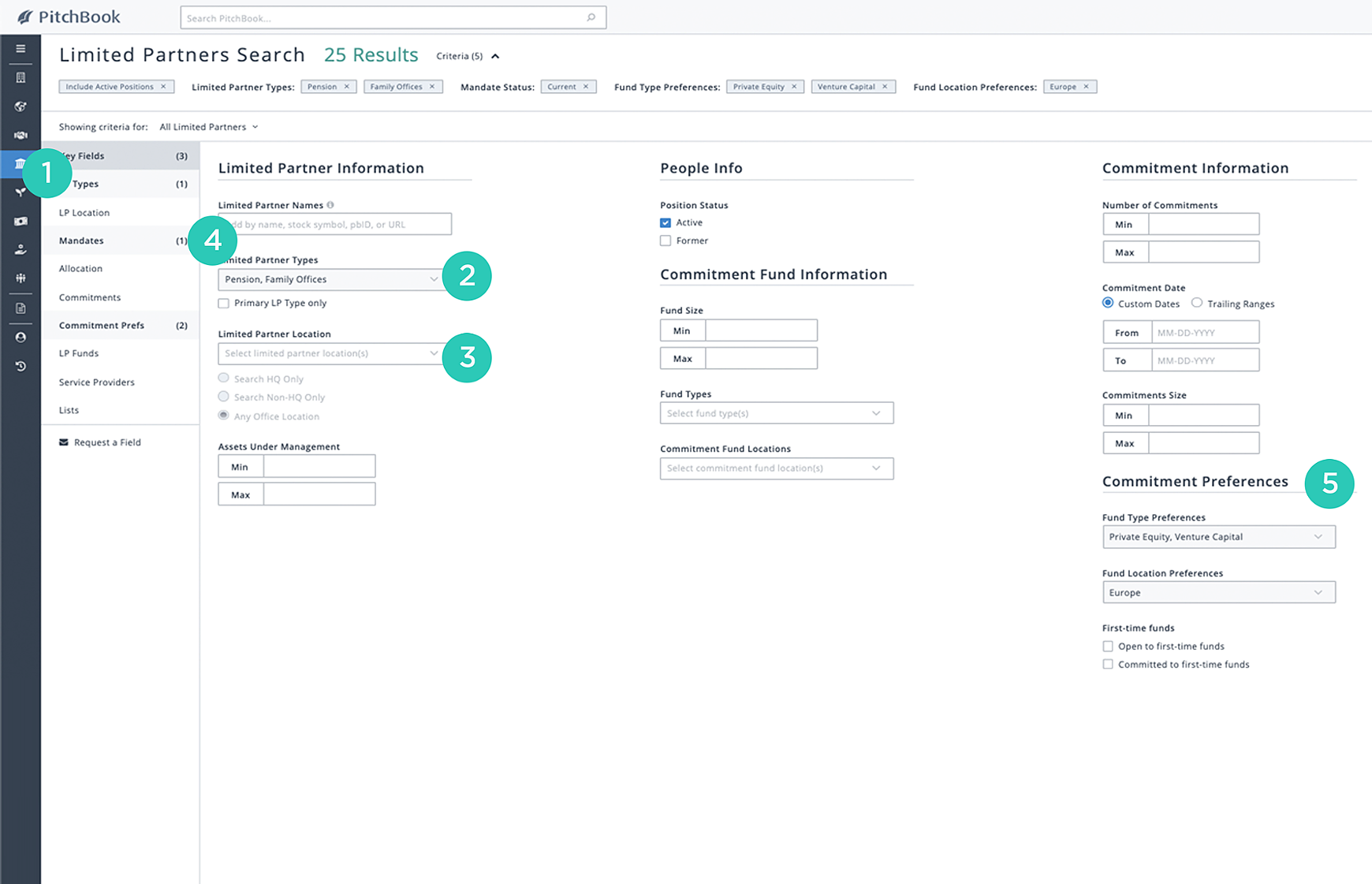

The screenshot below is intended to help users conduct a search for LPs in the PitchBook Platform. Each number is explained in the correlating boxes. These represent just a few options when choosing criteria for your search, but give an overall idea of how PitchBook helps you find institutional investors.

| 1 |

Conduct a limited partners search |

This search option will automatically set up the following advanced search fields for you to select from.

Whether it’s pension funds, investment firms, corporations, or any of the 26 limited partner types available on the platform, you can easily choose which ones you want to see.

Check “Search HQ Only” to target the main office and eliminate satellite branches. By selecting “any office location,” you can see the branches of an LP headquartered in another region.

You can select whether you want the mandate to be recently announced (current) or even look up any previous mandates (former). You can also select an “Investment Focus,” which helps identify any preferences of the fund manager’s investment behavior.

| 5 |

Enter commitment preferences |

It’s important to note that an LP’s stated preferences can differ greatly from their actual commitment history. You can use PitchBook to compare the two.

Learn more about how your firm can raise its next fund more efficiently by downloading our fundraising guide. It provides step-by-step instructions on how you can leverage PitchBook to quickly pick your own precise peer group, present a benchmark that highlights the value of your investment strategy and prioritize which investors to pursue—and tailor your pitch to their goals—using insights on their mandates, allocations, commitments, preferences and more.

Comments:

Thanks for commenting

Our team will review your remarks prior to publishing.

Please check back soon to see them live.