Spain

GPs bullish as Spanish private equity comes of age

January 23, 2020

In 2017, Tikehau Capital's head of Iberia, Carmen Alonso, set up the French firm's first Spanish operation with the goal of tapping into a growing opportunity. The new Madrid office would focus not only on the firm's core business of private debt, but across all private market strategies, including private equity and real estate. The operation secured its first PE deal in the country in December via its acquisition of Acek Energias Renovables' renewables business for a reported €81 million (around $90 million).

The deal, reportedly made via Tikehau's pan-European Energy Transition Fund, is not the only example of an investor launching or doubling down on Spanish PE activity.

In the same month as Tikehau's landmark deal, Spanish multinational Banco Santander announced that it would back newly formed SME alternative platform Tresmares Capital with a €175 million commitment to its private equity fund and contribute up to €900 million to its private debt vehicle. And this week, reports revealed Spanish GP Portobello Capital's plan to launch a €250 million fund for investment in the country.

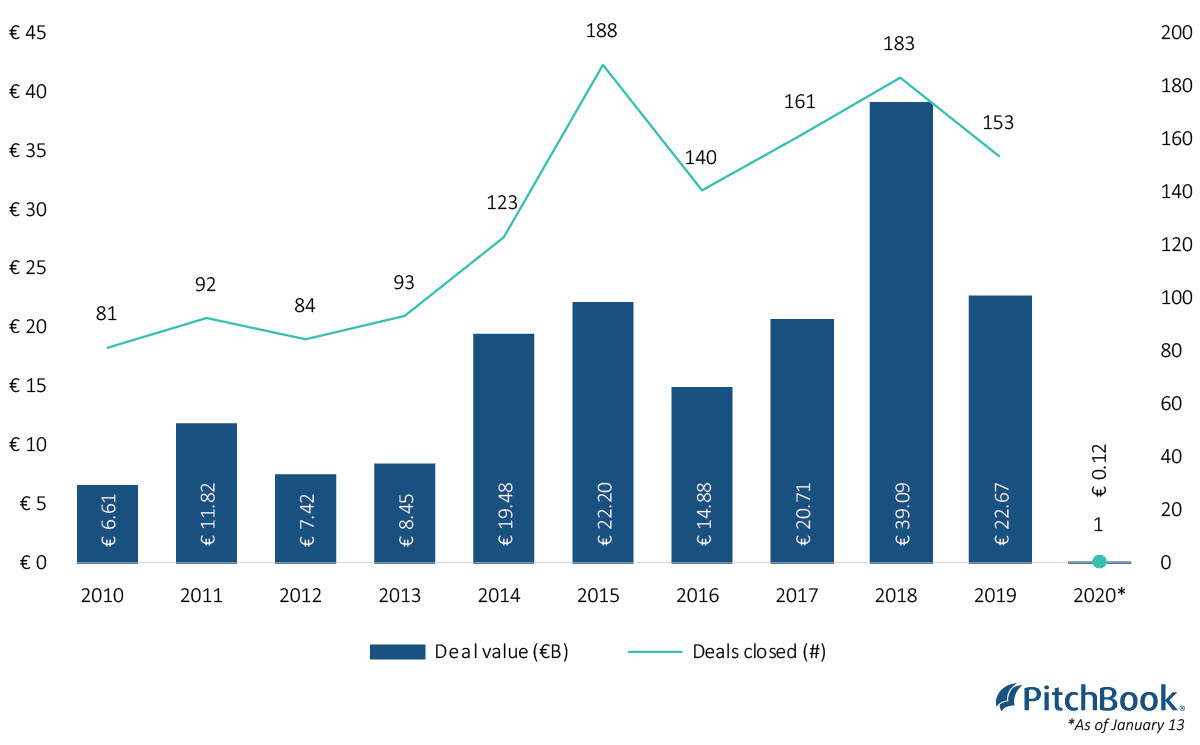

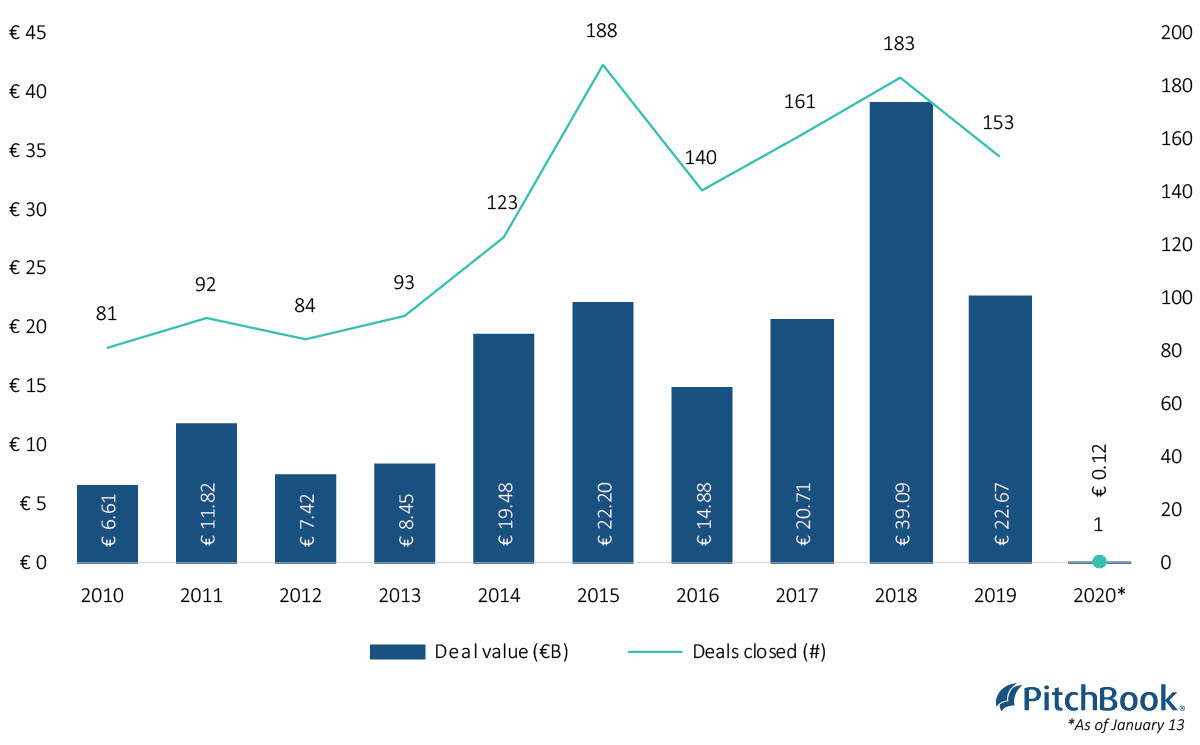

A look at PE deal flow in Spain reveals that the country has gone through something of a private equity renaissance. Spanish PE deal value reached a historic high in 2018, with just over €39 billion transacted across 183 deals, according to PitchBook data. Although last year saw a dip in total deal value to around €22.7 billion, it still represented the second-largest value of PE deals in Spain over the decade—and deal count was the fourth-largest during the time period. Furthermore, investors maintain that the underlying fundamentals of the country's PE market remain promising going into 2020.

The team at alternative asset manager Alantra Partners—a longtime Iberian incumbent deploying its third private equity fund, which brought in €450 million in 2017—is similarly buoyant.

"We have been in the Spanish market for around 30 years, we have seen the evolution of the private equity industry and in the last few years there's definitely been very positive growth ... family-owned companies, which are the bulk of the Spanish economy, are opening up much more easily to private equity investors," said David Santos, Alantra's Madrid-based partner.

Santos said that in the years following the global financial crisis—from 2008 to around 2014— more and more Spanish companies started looking to PE partners to help grow their companies by professionalizing their business operations. He added that the private equity market in Spain has notably evolved since the early years following the crisis.

But it's not just changes on the sell side that have spurred progress in the country.

The introduction of new private equity laws in Spain in 2014 and the introduction of government tax measures benefiting private equity funds have given GPs clarity and a solid legal framework to operate in. Over the years, the PE industry has seen a boost in commitments, thanks to Fond-ICO Global, a €2 billion government-run fund-of-funds program. Local investors, meanwhile, have become more sophisticated.

"GPs are becoming more professional in Spain and we have also had some international investors looking for opportunities in the country ... There is obviously much more room for growth than in other European markets because the Spanish market is less mature than the UK, French or the German market," added Santos.

Alonso notes that despite the uncertainty, it is too early to tell what potential implications this could have for the industry. For now, she remains cautiously optimistic: "I think when you look at the fundamentals of the country, it is true that the growth is slowing down, but nevertheless we continue to see positive growth and higher growth than in other European countries."

For his part, Alantra's Santos notes that the government attitude toward the industry has been positive overall, and he does not expect that to change: "In Spain, you have the best of both worlds. You have growth and on the other hand you have a single framework around private equity, and that is giving a lot of comfort to private equity investors."

Featured image via Copyright, Juan Pelegrin/Moment/Getty Images

The deal, reportedly made via Tikehau's pan-European Energy Transition Fund, is not the only example of an investor launching or doubling down on Spanish PE activity.

In the same month as Tikehau's landmark deal, Spanish multinational Banco Santander announced that it would back newly formed SME alternative platform Tresmares Capital with a €175 million commitment to its private equity fund and contribute up to €900 million to its private debt vehicle. And this week, reports revealed Spanish GP Portobello Capital's plan to launch a €250 million fund for investment in the country.

A look at PE deal flow in Spain reveals that the country has gone through something of a private equity renaissance. Spanish PE deal value reached a historic high in 2018, with just over €39 billion transacted across 183 deals, according to PitchBook data. Although last year saw a dip in total deal value to around €22.7 billion, it still represented the second-largest value of PE deals in Spain over the decade—and deal count was the fourth-largest during the time period. Furthermore, investors maintain that the underlying fundamentals of the country's PE market remain promising going into 2020.

Making progress

"[Spain has] come out of the crisis quite strong and businesses have invested heavily in changing their positioning and, rather than just focusing on growing the Spanish market, are looking at internationalizing their products, their clients and being significantly more diversified,” said Alonso. She thinks Spanish and international investors are starting to see the growth potential of Spanish companies, the maturity of the sector and the quality of middle-market businesses.The team at alternative asset manager Alantra Partners—a longtime Iberian incumbent deploying its third private equity fund, which brought in €450 million in 2017—is similarly buoyant.

"We have been in the Spanish market for around 30 years, we have seen the evolution of the private equity industry and in the last few years there's definitely been very positive growth ... family-owned companies, which are the bulk of the Spanish economy, are opening up much more easily to private equity investors," said David Santos, Alantra's Madrid-based partner.

Santos said that in the years following the global financial crisis—from 2008 to around 2014— more and more Spanish companies started looking to PE partners to help grow their companies by professionalizing their business operations. He added that the private equity market in Spain has notably evolved since the early years following the crisis.

But it's not just changes on the sell side that have spurred progress in the country.

The introduction of new private equity laws in Spain in 2014 and the introduction of government tax measures benefiting private equity funds have given GPs clarity and a solid legal framework to operate in. Over the years, the PE industry has seen a boost in commitments, thanks to Fond-ICO Global, a €2 billion government-run fund-of-funds program. Local investors, meanwhile, have become more sophisticated.

"GPs are becoming more professional in Spain and we have also had some international investors looking for opportunities in the country ... There is obviously much more room for growth than in other European markets because the Spanish market is less mature than the UK, French or the German market," added Santos.

The unknown

While private equity has enjoyed a relatively benign regulatory environment in recent years, the November re-election of Spain's left-leaning prime minister Pedro Sanchez has resulted in uncertainty around the government's future relationship with private equity. Sanchez has been critical of alternative asset managers in the past, reportedly accusing Goldman Sachs of being "vulture" over social housing investments in 2018.Alonso notes that despite the uncertainty, it is too early to tell what potential implications this could have for the industry. For now, she remains cautiously optimistic: "I think when you look at the fundamentals of the country, it is true that the growth is slowing down, but nevertheless we continue to see positive growth and higher growth than in other European countries."

For his part, Alantra's Santos notes that the government attitude toward the industry has been positive overall, and he does not expect that to change: "In Spain, you have the best of both worlds. You have growth and on the other hand you have a single framework around private equity, and that is giving a lot of comfort to private equity investors."

Featured image via Copyright, Juan Pelegrin/Moment/Getty Images

Comments:

Thanks for commenting

Our team will review your remarks prior to publishing.

Please check back soon to see them live.